The partners decide to dissolve the partnership. They are offered £40,000 for the building and the fixtures

and fittings. Aoife agrees to take over one car at a value of £2,500 and Declan takes over the other

remaining car at a value of £2,000. It turns out that £2,500 of the trade receivable are bad and the sundry

payables have promised to give the partners, on average 10% discount on settlement of the debt owed to

them if it is paid for on the 1 January 20X2. The loan will be paid off in full on that date. All the monies

in and out will occur on the 1 January 20X2. The dissolution expenses amount to £2,200.

Questions 1 to 4 should be answered from this following information

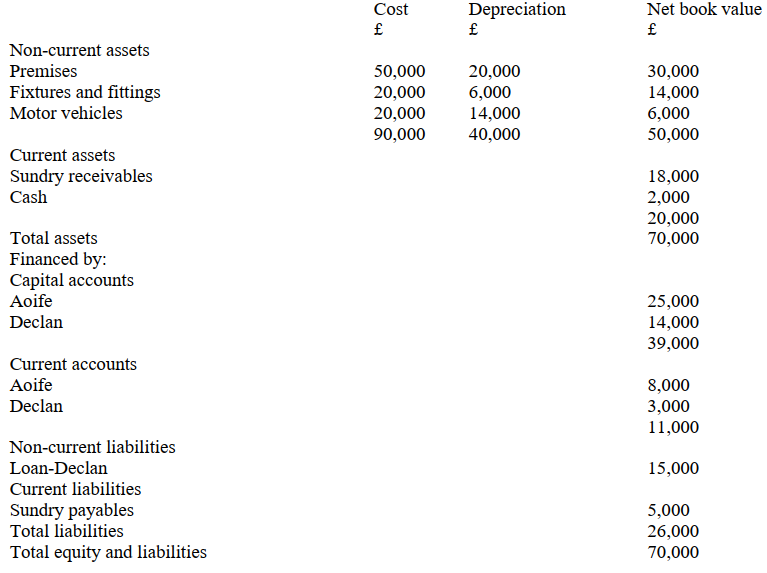

Aoife and Declan are in partnership, sharing profits equally. Their draft statement of financial position is

as follows:

-What payment/receipt from/to Declan is required to close his capital account on the dissolution of the partnership?

A) Receipt from Declan of £10,000

B) Payment to Declan of £10,000

C) Payment to Declan of £12,000

D) Payment to Declan of £17,000

Correct Answer:

Verified

Q1: The partners decide to dissolve the partnership.

Q2: The partners decide to dissolve the partnership.

Q4: The partners decide to dissolve the partnership.

Q5: When there is a credit balance brought

Q6: The partnership is being dissolved and converted

Q7: A partnership has reported profit for the

Q8: In a partnership the double entry to

Q9: In a partnership the double entry to

Q10: After receipt of all monies on the

Q11: When there is a credit balance carried

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents