Stimpy has £100,000 of capital invested in the partnership on 1 January 20X1. He introduced a further £50,000 on 1 July 20X1. The partnership has a year end of 31 December 20X1. The partnership agreement states that interest should be credited to partners at the rate of 5% per annum on capital invested in the partnership. The interest on this drawing for the year to 31 December 20X1 will be

Recorded as follows:

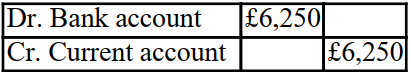

A)

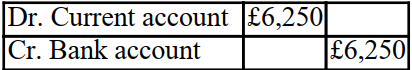

B)

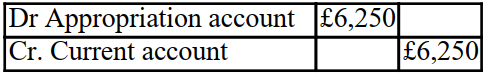

C)

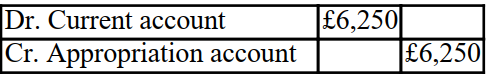

D)

Correct Answer:

Verified

Q1: In the absence of a partnership agreement

Q2: In the absence of a partnership agreement,

Q4: What is the net movement in the

Q5: What is the net movement in the

Q6: If the profit for the year before

Q7: If the profit for the year before

Q8: If the profit for the year before

Q9: If the profit for the year before

Q10: Which of the following is not usually

Q11: Which of the following items will not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents