Questions are based on the following information:

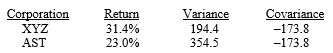

The returns, variances, and covariances of annual returns for XYZ Corp. and AST Inc. have been calculated for the period 1999-2008 (n = 10) . The values are:

-If the mean return and variance for the market (S&P/TSX Composite Index) for the period were 18.2 percent and 161.1 respectively, and the covariance between AST and S&P/TSX Composite Index was 159.4, the beta for AST would have been:

A) less than zero, negative.

B) between zero and .50.

C) between .50 and 1.00.

D) greater than 1.00.

Correct Answer:

Verified

Q9: Which of the following statements best summarizes

Q10: The slope of the CML is

Q11: Select the correct statement regarding the market

Q12: The systematic risk level of a security:

A)

Q13: Questions are based on the following information:

The

Q15: Select the statement which correctly describes the

Q16: In the Capital Asset Pricing Model,

Q17: Choose the statement below that is not

Q18: In the equation for the Security

Q19: Which statement is incorrect?

A) The RF is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents