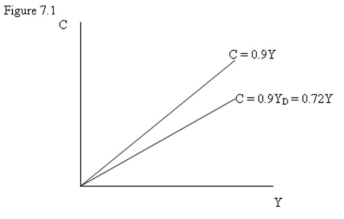

-Refer to Figure 7.1. The diagram shows one consumption function with zero income tax and the other consumption function with 20% income tax rate. We can conclude all of the following except one. The exception is:

A) The consumption curve with income tax is flatter than the consumption curve without income tax.

B) The slope of the consumption curve with income tax is 0.70.

C) The autonomous expenditure multiplier will be lower with income-tax.

D) Higher the income tax rate, lower the slope of the consumption curve and lower will be slope of the AE curve.

Correct Answer:

Verified

Q9: Other things remaining the same, an increase

Q10: If income tax rate increases:

A) disposable income

Q11: Other things constant, if the government imposes

Q12: Assume that the MPC out of disposable

Q13: A $1 increase in government spending will

Q15: If the MPC is 0.8, the net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents