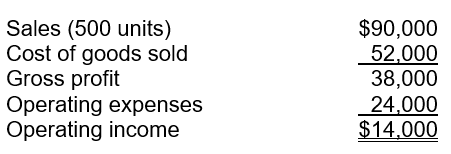

Elmwood Environmental manufactures compost kits. For the past year, the company reported the following operating results while operating at 50% of plant capacity:  An analysis of costs and expenses reveals that variable cost of goods sold is $95 per unit and variable operating expenses are $35 per unit. In January, Elmwood Environmental receives a special order for 500 compost kits at $135 each from a local municipality.Acceptance of the order require an addition $1,000 of shipping costs, but would not affect the fixed expenses.

An analysis of costs and expenses reveals that variable cost of goods sold is $95 per unit and variable operating expenses are $35 per unit. In January, Elmwood Environmental receives a special order for 500 compost kits at $135 each from a local municipality.Acceptance of the order require an addition $1,000 of shipping costs, but would not affect the fixed expenses.

a. Prepare an analysis to determine if the special order should be accepted.

b. What decision should Elmwood make regarding the special order, accept or reject? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Dynamic Designs has three product lines in

Q103: HomeGoods Corporation operates two divisions, the Commercial

Q104: The Nut House sells three different types

Q105: Barton Beverages Inc. sells cases of bottled

Q106: Addison Accounting LLP has the following financial

Q108: Antsy Labs produced and sold 50,000 fidgets

Q109: Vermont Teddy Bear Company makes a special

Q110: The following operating data was reported by

Q111: Speed Tek produces two models of professional

Q112: Pate & Murwick, CPAs, employs partners, managers

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents