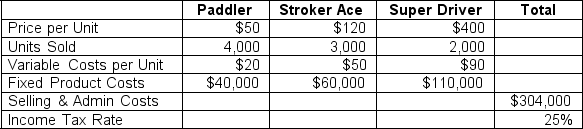

Crest Canoe Co. produces and distributes three types of oars to accompany its various canoe product lines. Financial information for the past year on these three oars is as follows:  Assuming that Crest's overall sales mix for its oars remains the same and fixed costs increase by $100,000 per year, calculate and provide the following additional information:

Assuming that Crest's overall sales mix for its oars remains the same and fixed costs increase by $100,000 per year, calculate and provide the following additional information:

a. What is Crest Canoe's degree of operating leverage (DOL)? (Round to 4 decimal places)

b. What is Crest's operating income after taxes?

c. What is the current margin of safety in terms of sales revenue dollars? (Hint: Compute the contribution margin ratio for the company (total).Round to nearest whole dollar)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: Emerald City Jewelers has two products it

Q149: As a result of cost increases imposed

Q150: Zapple, Ltd. is producing and distributing a

Q151: Crest Canoe Co. produces and distributes three

Q152: Crest Canoe Co. produces and distributes three

Q154: Crest Canoe Co. produces and distributes three

Q155: Crest Canoe Co. produces and distributes three

Q156: Dynamic Designs has fixed costs of $380,000

Q157: Dynamic Designs has fixed costs of $380,000

Q158: Dynamic Designs has fixed costs of $380,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents