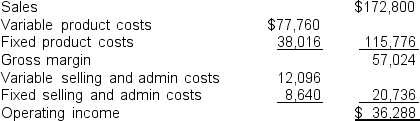

Accent produces reading lamps and sells each for $18 to distributors. Accent's June income statement follows:  Accent's income tax rate is 30%.

Accent's income tax rate is 30%.

a. How much sales revenue must Accent generate to achieve a target profit after taxes of $25,000?

b. How much contribution margin will Accent generate when the company generates profit after taxes of $25,000?

c. What effect does an increase in the income tax rate from 30% to 32% have on the break-even point? Explain.

d. Accent's manager is planning to give each of its hourly production employees a 5% raise and plans to offset it with an increase in the selling price of each lamp by 5%. During June, the direct labor cost totaled $34,992. Provide the manager with insight into the effect of this increase on profitability.

e. Why do the two 5% changes in part d not offset each other, resulting in no change in the contribution margin?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q167: Clemens Business Consulting provides management-consulting evaluations for

Q168: SoniCo operates the Annabell Lee, a riverboat

Q169: Waldo's Water World is distributing replacement water

Q170: Hooper's Hot Dog Stand has had the

Q171: Clark Craven started his own business, Craven

Q173: Speed Tek produces two models of professional

Q174: The following operating data was reported by

Q175: Mini Baker products mini cupcakes in various

Q176: Pate & Murwick, CPAs, employs 22 professional

Q177: Briefly describe why break-even analysis is important

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents