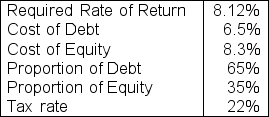

Smith Industries is in desperate need of a new press machine for their production department. The manager has been asked to select the most favorable option while keeping in mind that any decision made may also impact their department's evaluation. Given this, the manager knows that performing a thorough analysis is crucial. A machine could be purchased from Grove Inc. for a total cost of $9,677 and would generate Operating Income of $3,705. A different machine could be purchased from Forest Inc. for a total cost of $9,003 and would generate Operating Income of $3,432. The company has provided the following information:  What is the percentage difference in EVA for the press machine from Grove when compared to the press machine from Forest? (Do not round intermediate calculations.)

What is the percentage difference in EVA for the press machine from Grove when compared to the press machine from Forest? (Do not round intermediate calculations.)

A) The EVA of the press machine from Forest is 7.49% higher than the EVA of the press machine from Grove.

B) The EVA of the press machine from Forest is 8.1% higher than the EVA of the press machine from Grove.

C) The EVA of the press machine from Grove is 7.49% higher than the EVA of the press machine from Forest.

D) The EVA of the press machine from Grove is 8.1% higher than the EVA of the press machine from Forest.

Correct Answer:

Verified

Q61: A company has gathered the following information

Q62: A company has gathered the following information

Q63: Oscar is the manager of the component

Q64: Oscar is the manager of the component

Q65: Smith Industries is in desperate need of

Q67: Landry Corp. is evaluating one of its

Q68: Landry Corp. is evaluating one of its

Q69: All business units are created with certain

Q70: The crinkle-cut division of a French fry

Q71: The crinkle-cut division for a French fry

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents