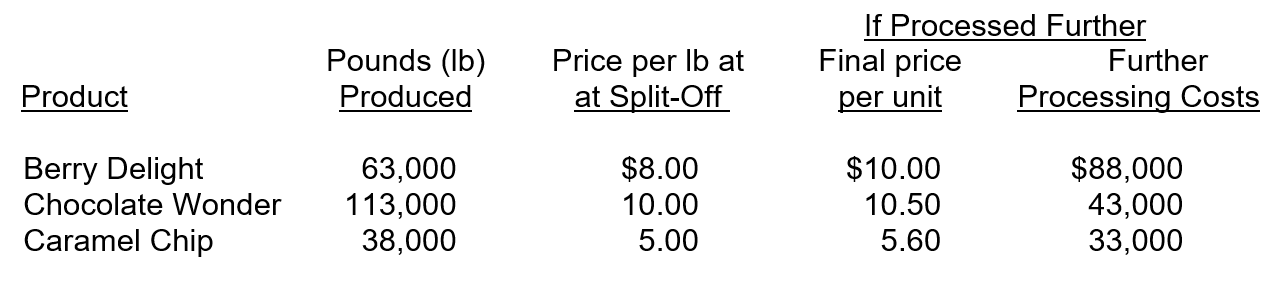

The Sweete Shoppe produces a variety of sweet treats. Several treats can be sold at split-off or further processed to produce a different type of treat. The following three treats are all produced in a joint processing operation at a cost of $63,000. The costs are allocated based on pounds produced. Information for these treats is as follows:  The joint processing costs for these treats

The joint processing costs for these treats

A) should be allocated to the treats to determine whether they should be sold at split-off or processed further.

B) should be ignored in determining whether they should be sold at split-off or processed further.

C) should be ignored in making all product decisions.

D) are never included in the product costs and can mislead management in the decision-making process.

Correct Answer:

Verified

Q75: The Sweete Shoppe produces a variety of

Q76: The Sweete Shoppe produces a variety of

Q77: The Sweete Shoppe produces a variety of

Q78: The Sweete Shoppe produces a variety of

Q79: The Sweete Shoppe produces a variety of

Q81: All the following statements are true regarding

Q82: When a company produces a by-product along

Q83: The production method of accounting for the

Q84: The sales method of accounting for the

Q85: Using the production method to account for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents