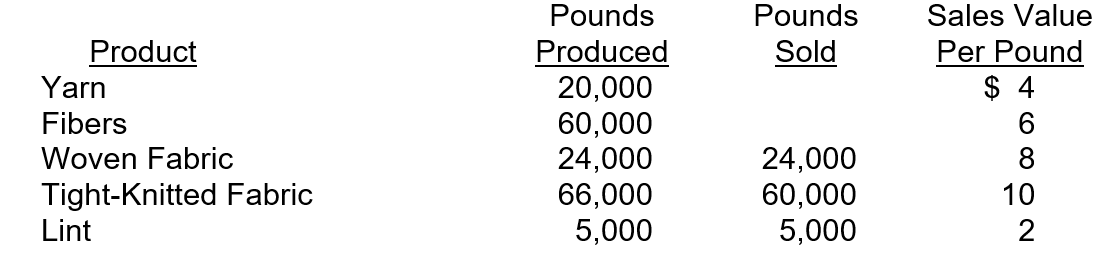

Wooly Productions is a cotton mill that produces a variety of products. The Yarn and Fibers are produced using a joint process that costs $80,000. Lint is also produced as part of the joint process but is produced in a small quantity and not part of the general sale of the company but more of an after-thought with a marketable value. The Yarn and Fibers can be produced further into Woven Fabric and Tight-Knitted Fabric. The cost to process these further is 120,000 (Yarn to Woven Fabric) and 140,000 (Fibers to Tight-Knitted Fabric). Wooly has identified a market for all the products they produce but determined that the Yarn and Fibers would be processed further as the income appears to be greater. You have been asked to run some analysis and prepare some journal entries to assist Wooly in achieving the highest net income based on the products it produces. The following information has been provided to assist with your analysis.  Instructions:

Instructions:

a. Wooly uses the NRV to allocate joint costs and the production method to account for by-products

1) Allocate the joint costs to each product.

2) Calculate the gross margin for each product.

3) Prepare the journal entry to record the completion of the products.

4) Prepare the journal entry to record the sale of the primary products.

5) Prepare the journal entry to record the sale of the by-product.

b. Wooly uses the NRV to allocate joint costs and the sales method to account for by-products.

1) Allocate the joint costs to each product.

2) Calculate the gross margin for each product.

3) Prepare the journal entry to record the completion of the products.

4) Prepare the journal entry to record the sale of the primary products.

5) Prepare the journal entry to record the sale of the by-product.

c. Since not all the Tight-Knitted Fabric produced was sold, calculate the ending inventory of the Finished Goods Inventory account.

1) using the production method to account for by-products.

2) using the sales method to account for by-products

d. Is Wooly making a good decision to process both products further? (Assume all Yarn and Fibers produced could also be sold) Support your answer with calculations.

Correct Answer:

Verified

1. Woven Fabric $8,514

Tight-Knitte...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Kreider Farms produces three products and one

Q119: Gene started a business that retrieves golf

Q120: Blender Corporation produces two products, cheese, and

Q121: Payton Company uses a joint process to

Q122: Napa Productions produces Salsa and Spaghetti

Q123: Concrete Mixtures created cement lawn ornaments for

Q124: Creekside Winery produces three types of wine,

Q125: Carpets N More produces carpet for commercial

Q126: Honey Bees produces pure honey and distributes

Q128: Red Hot manufactures a variety of red

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents