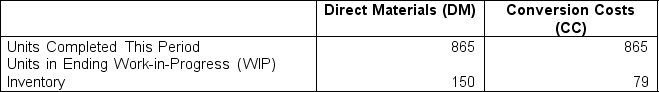

The sewing process used by TradeMark Inc. began the year with an inventory of $3,820. Using the Weighted-Average method, they calculated their equivalent units of production for this calendar year to be: TradeMark has calculated their cost per equivalent unit as follows: Direct Material $84 and Conversion Costs $43. How much cost should TradeMark assign to the units completed and removed from WIP inventory in the current year using the Weighted-Average method?

TradeMark has calculated their cost per equivalent unit as follows: Direct Material $84 and Conversion Costs $43. How much cost should TradeMark assign to the units completed and removed from WIP inventory in the current year using the Weighted-Average method?

A) $89,080

B) $109,855

C) $113,675

D) $125,852

Correct Answer:

Verified

Q75: Almondz Co. has equivalent costs for Direct

Q76: Pete's Gold Co. is a factory that

Q77: Pete's Gold Co. is a factory that

Q78: The sewing process used by TradeMark Inc.

Q79: The sewing process used by TradeMark Inc.

Q81: At John & Mary Corp., 1,000 units

Q82: Tom & Joy Company follows the Weighted-Average

Q83: Nancy & Kary Corp., follow the Weighted-Average

Q84: In an intermediate process named Polishing, the

Q85: A factory is entering its second year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents