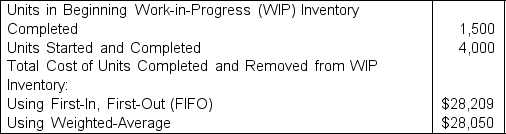

The Cost Accountant of an organization, Jimmy, has been tasked with suggesting the inventory valuation method such that the gross margin percentage of an organization is higher than it currently is. He has the following estimated information on hand: The selling price of a unit is estimated at $7.50. What would the gross margin percentage Jimmy will arrive at be, using both FIFO and Weighted-Average respectively? (Round cost per unit to nearest cent.)

The selling price of a unit is estimated at $7.50. What would the gross margin percentage Jimmy will arrive at be, using both FIFO and Weighted-Average respectively? (Round cost per unit to nearest cent.)

A) 31.60% for FIFO and 32.00% for Weighted-Average

B) 32.50% for FIFO and 31.80% for Weighted-Average

C) 40.00% for FIFO and 50.00% for Weighted-Average

D) 41.30% for FIFO and 42.70% for Weighted-Average

Correct Answer:

Verified

Q85: A factory is entering its second year

Q86: Annie, the accountant for a local cookie

Q87: Sticky Fingers Corp is a manufacturer of

Q88: Lucky Charm is a factory that molds

Q89: For a particular period, Jack, who is

Q91: An organization follows the Weighted-Average method of

Q92: Carmine Inc. creates all of its parts

Q93: Carmine Inc. creates all of its parts

Q94: Stryker Industries produces stethoscopes made from steel

Q95: Stryker Industries produces stethoscopes made from steel

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents