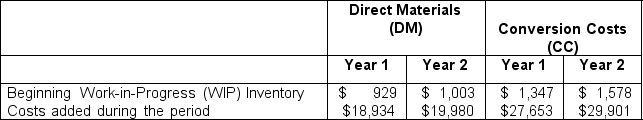

Chocolate Innovations is a factory that currently produces gourmet chocolate truffles that they sell in boxes of 50 truffles. They also produce chocolate turtles that are sold in boxes of 25 candies. Their accountant, Melissa, is gathering information about their performance over the two most recent years so that they can make an official decision as to whether they will use the First-In, First-Out (FIFO) or Weighted-Average method for their Process Costing. Melissa has been keeping general records for two years before making a strong suggestion one way or another. She has collected the following cost information regarding the truffles:

Melissa also compiled production information for both years for the truffles:

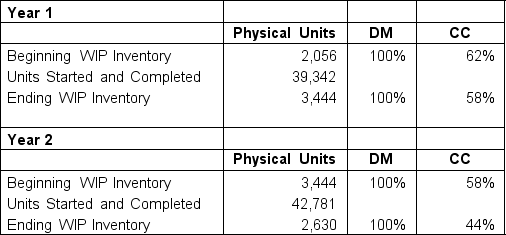

Melissa also compiled production information for both years for the truffles:

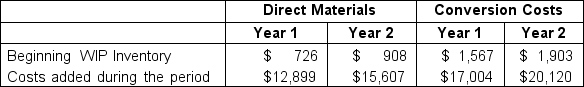

She has collected the following cost information regarding the turtles:

She has collected the following cost information regarding the turtles:

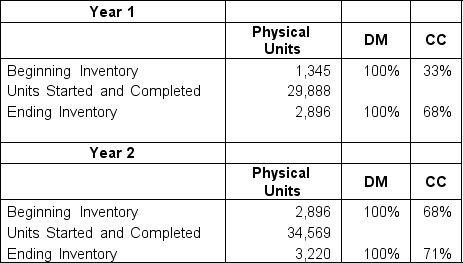

Melissa also compiled production information for both years for the turtles:

Melissa also compiled production information for both years for the turtles:

Chocolate Innovations plans on selling each box of truffles for $75.00 and each box of turtles for $48.00.

Chocolate Innovations plans on selling each box of truffles for $75.00 and each box of turtles for $48.00.

(Round units to whole number and dollar amount to two decimal places.)

a. What is the equivalent cost per unit for both Direct Materials and Conversion Cost for truffles for Year 1 under both FIFO and Weighted-Average?

b. What is the equivalent cost per unit for both Direct Materials and Conversion Cost for truffles for Year 2 under both FIFO and Weighted-Average?

c. What is the equivalent cost per unit for both Direct Materials and Conversion Cost for turtles for Year 1 under both FIFO and Weighted-Average?

d. What is the equivalent cost per unit for both Direct Materials and Conversion Cost for turtles for Year 2 under both FIFO and Weighted-Average?

e. Using horizontal analysis, what is the increase year-to-year for all costs under both FIFO and Weighted-Average? What is the gross profit percentage for each box of truffles and each box of turtles for year 2?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q129: Crushed Inc. is a factory that manufactures

Q130: Wooly Corp. produces wool scarves, and they

Q131: Inky Pens Inc. is a factory that

Q132: Hot Cakes Co. manufactures dry pancake mix,

Q133: Simply Charmed produces silver lockets that it

Q134: Pearl's is a high-end skincare line that

Q135: Tiny Packs produces leather backpack purses that

Q136: Retro Minis is a company that specializes

Q137: Ethan is the owner of Refresher Corp.,

Q139: MCM Revisit manufactures mid-century modern inspired bookcases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents