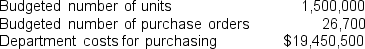

Candy is having a meeting with Sharon, a member of the management team at the retail company where they are both employed. They are currently discussing the way that the purchasing department's costs are being handled. Candy believes that these costs should be considered a unit-level cost and allocated based upon the number of units needed as that dictates what the department purchases. Sharon believes that the costs should be allocated on a batch level based on the number of purchase orders used for each area. Candy has compiled some data on both cost drivers and the total costs for the purchasing department.

Their one product line requires 62 purchase orders this year in order to purchase 27,400 units.

Their one product line requires 62 purchase orders this year in order to purchase 27,400 units.

(If required, round calculations to two decimal places.)

a. How much of the purchasing cost would be allocated under Candy's unit-level assumption?

b. How much of the purchasing cost would be allocated under Sharon's batch-level assumption?

c. Which method would you recommend that Candy and Sharon use for this retail company?

Correct Answer:

Verified

The first step would be t...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: Shawn is a general contractor who has

Q126: Carol is the controller for Stormy Corp.,

Q127: Paisley Corp. is a clothing company that

Q128: Flamingo Inc. is an organization that produces

Q129: Delightful Desserts manufactures gluten-free desserts, including their

Q131: Trivium Inc. is a retail business that

Q132: Santana is a staff accountant for Tapestry,

Q133: Bill owns Owens Construction, a small general

Q134: Aubrey is an accountant for Arbor Town,

Q135: Tech Squad is a regional call center

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents