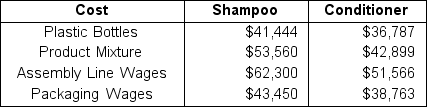

Primrose Inc. manufactures high quality hair care products. Their most recent success has been a rose-scented conditioner for fine hair to accompany their best-selling rose-scented shampoo. This has been a great year for Primrose with sales of shampoo reaching 105,600 bottles and sales of their new conditioner reaching 86,420 bottles. Their controller, Jeff, has compiled the following information pertaining to their materials and labor usage for both the shampoo and conditioner:

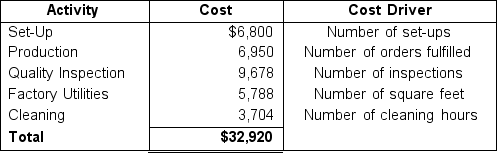

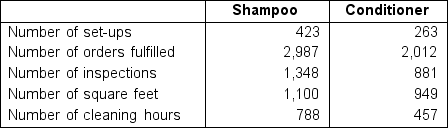

Primrose has chosen to allocate their Manufacturing Overhead (MOH) costs by using a single plant-wide MOH rate that is based upon Total Direct Labor (DL) costs. Primrose has been looking into ways that it can improve how it allocates and tracks costs. Jeff has suggested the use of Activity-Based Costing (ABC) and has identified the following common key activities, associated cost information, and quantity of each driver:

Primrose has chosen to allocate their Manufacturing Overhead (MOH) costs by using a single plant-wide MOH rate that is based upon Total Direct Labor (DL) costs. Primrose has been looking into ways that it can improve how it allocates and tracks costs. Jeff has suggested the use of Activity-Based Costing (ABC) and has identified the following common key activities, associated cost information, and quantity of each driver:

Jeff would like to assist management by their next meeting. While keeping all of his data and compilations in mind, please provide some insight into the following questions. (If required, round calculations to two decimal places.)

Jeff would like to assist management by their next meeting. While keeping all of his data and compilations in mind, please provide some insight into the following questions. (If required, round calculations to two decimal places.)

a. What is Primrose's budgeted manufacturing overhead rate in percentage form using one plant-wide pool? What are Primrose's activity-based rates using the identified key activities and respective cost drivers? (Round percentage figure to two decimal places.)

b. Allocate manufacturing overhead costs to the rose-scented shampoo using the activity-based rates calculated in part (a), and present one total number, and do the same for the rose-scented conditioner.

c. What are the total costs per unit for the rose-scented shampoo using both costing methods?

d. What are the total costs per unit for the rose-scented conditioner using both costing methods?

e. Why are the allocated MOH costs different between using a single plant-wide rate and using ABC? How might these differences impact Primrose's costing decisions in the future? Which method do you think Jeff will encourage Primrose to use?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Trivium Inc. is a retail business that

Q132: Santana is a staff accountant for Tapestry,

Q133: Bill owns Owens Construction, a small general

Q134: Aubrey is an accountant for Arbor Town,

Q135: Tech Squad is a regional call center

Q136: Lilly Corp. manufactures office supplies that it

Q137: Fly Ball Inc. is a sporting goods

Q138: Garden Variety is an organization that manufactures

Q139: Magic Golf is a small putt putt

Q140: Lately Twisty Noodles, a regional factory that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents