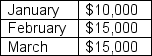

Mike is concerned about the cash receipts schedule of his business since all of the business's customers deal in credit instead of cash. Based on historical data, he is expecting to receive collections on accounts receivable (A/R) as follows: 55% in the month of sale, 40% in the next month after the sale, and 5% becomes uncollectible. Mike has decided to write off the business's uncollectible A/R at the end of second month after the sale. The following table provides the month-by-month summary of sales for Mike's business: How much uncollectible A/R will Mike write off at the end of May?

How much uncollectible A/R will Mike write off at the end of May?

A) $500

B) $750

C) $1,500

D) $2,000

Correct Answer:

Verified

Q82: Fescue, Inc. is in a lawncare business

Q83: Daisy Company is a customer service organization

Q84: Sara, working as a manager in the

Q85: The following table represents the credit sales

Q86: The following table represents the credit sales

Q88: The following table shows the cash schedule

Q89: Dymund Group reports the sale of 16,000

Q90: The Green Retail store is planning to

Q91: Sea Salt Manufacturing Company's policy is to

Q92: The CFO of M Corp estimates the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents