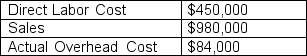

Luca Pacioli, CPA, founder of Double-Entry Accountants, LLC, a service firm, provides the following information for the most recent year of operations.

Double-Entry Accountants, LLC, applies overhead at a rate of 20% of Direct Labor Cost.

Double-Entry Accountants, LLC, applies overhead at a rate of 20% of Direct Labor Cost.

Any underapplied or overapplied overhead is eliminated by closing the amount out to Cost of Sales, using the Direct Write-Off Method.

Instructions: Students should compute the following items based upon the provided information.

a. Determine the amount of underapplied or overapplied manufacturing overhead.

b. Prepare the journal entry to dispose of any overapplied or underapplied manufacturing overhead.

c. Compute firm's gross margin that will appear on Double-Entry Accountant's income statement, after adjustments are made.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Chris Regington, an entry-level accountant at Global

Q111: Marconi Industries manufactures WiFi enabled digital radios.

Q112: Marconi Industries manufactures WiFi enabled digital radios.

Q113: Regington Computers uses a job-order costing system.

Q114: Honest Auto Repairs is a service firm

Q116: Cool Vision Inc. produces polarized sunglasses. During

Q117: Alexa Anderson, the manager of Aromatic Air

Q118: Precision Construction Company is concerned about ongoing,

Q119: In its job costing system, Jupiter Co.

Q120: In 2025, Bancroft Company was the victim

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents