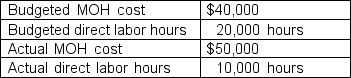

The Sunshine Corporation produces solar panels. At the end of the most recent fiscal year, Sunshine's cost accountant, Beth, reviewed relevant cost data, focusing on MOH. Since her company uses normal costing, she anticipated a difference in the amount of MOH that was applied compared to the amount that was actually incurred. However, Beth was shocked at the size of the differential. Here is what she found within the MOH account, as well as detail from the beginning of the year when the budgeted MOH rate was determined:

Beth is aware of the following company policy regarding any MOH difference: "any MOH difference that is deemed not significant should be written off in full, in the current period; any MOH difference that is deemed significant should be prorated to the appropriate

Beth is aware of the following company policy regarding any MOH difference: "any MOH difference that is deemed not significant should be written off in full, in the current period; any MOH difference that is deemed significant should be prorated to the appropriate

accounts so as to better approximate actual costs".

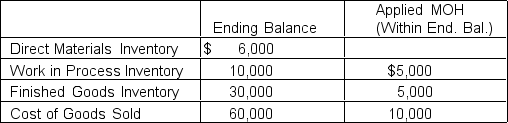

Beth also accessed the following additional information related to the inventory

accounts.

While she does not yet have a clear understanding of what amount might be considered

While she does not yet have a clear understanding of what amount might be considered

significant yet, Beth knows she must first calculate the difference between actual MOH

and applied MOH.

Required:

a. Calculate the budgeted MOH rate for Beth's company, assuming that direct labor hours is the cost driver.

b. Determine whether the MOH is under or overapplied, and by how much.

c. Since Beth is unsure if the amount of overapplied or underapplied would be considered significant, she decides to do the work for both options so that she can bring it to her supervisor and ask for additional guidance regarding significance.

(For the following, round any rates or proportions to four decimal places, and round final dollar amounts to the nearest dollar).

1) Prepare the journal entry if the MOH difference between MOH applied and MOH actually incurred is to be written off entirely in the current period.

2) Prepare the calculations and journal entry necessary if the difference between MOH applied and MOH actually incurred is to be prorated to the appropriate inventory and cost accounts based on their ending balances.

Correct Answer:

Verified

Budgeted M...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Atlas Analytics Inc. produces voice-activated navigation systems.

Q128: Wright Bros. Inc. manufacturers retro bicycles. Their

Q129: Ketogenic Inc. produces delicious, healthy snack bars,

Q130: PPE Inc. manufactures highly specialized, custom protective

Q131: Pizza3.144 Inc. produces tactical laser-guided pizza cutters,

Q133: Boston Bean Counter Corporation produces advanced, highly

Q134: In 2025, for the second time in

Q135: Jurassic Manufacturing Inc., located in Flint, Michigan,

Q136: Companies that use normal costing, apply manufacturing

Q137: "Normal Costing" and "Actual Costing" are two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents