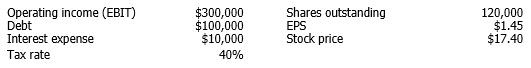

The following information applies to Shilling Medical Supplies: The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40) . The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40) . The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

Assume that the recapitalization has no effect on the company's price earnings (P/E) ratio. What is the expected price of the company's stock following the recapitalization?

A) $15.00

B) $16.25

C) $17.40

D) $18.00

E) $20.88

Correct Answer:

Verified

Q6: Damon Corporation's value with no debt is

Q7: Lowe Co. has a capital budget of

Q8: Martinez Brothers Imports has a current debt

Q9: Kapler Inc. expects EBIT of $2,000,000 for

Q10: Ramirez Supplies believes that at its current

Q12: Foulke Enterprises has no debt, and is

Q13: The theories proposed by Professors Modigliani and

Q14: Describe how the various Modigliani and Miller

Q15: Differentiate between internal and external corporate dividend

Q16: Are capital structures around the world generally

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents