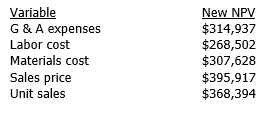

Hartley Corp. is considering a project that could be a "make-it-or-break-it" project for the firm. Using its managers' input variable estimates, the project has a positive NPV = $334,492. Naturally, Hartley is quite concerned about the input variables it has used. A sensitivity analysis has been performed on a few of the key variables. Below, are the values of the resulting NPVs if the corresponding input variable is changed by 1 percent. What is the sensitivity index of the variable that has the most importance in terms of the project's value?

A) 10.1%

B) -13.8%

C) 18.4%

D) -19.7%

E) 20.8%

Correct Answer:

Verified

Q1: The textbook suggests that real options may

Q2: The textbook suggests that while risk analysis

Q4: McGaven & Associates is considering an investment

Q5: Carhart Towers Inc. is considering a proposed

Q6: Brett Co. just purchased a new delivery

Q7: Cosgrove Technologies is considering a project that

Q8: Differentiate between stand-alone, corporate, and market risk.

Q9: Describe abandonment, growth, investment timing, and flexibility

Q10: Describe some methods of analyzing project stand-alone

Q11: Explain how a real option on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents