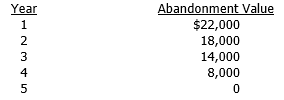

Persia Shipping just purchased a new delivery truck. The new truck cost $30,000 and is expected to generate net after-tax operating cash flows, including depreciation, of $8,000 at the end of each year. The truck has a 5-year expected life. The expected abandonment values (salvage values after tax adjustments) at different points in time are given below. (Note that these abandonment value estimates assume that the truck is sold after receiving the project's cash flow for the year.) The firm's cost of capital is 10 percent.

At what point in time would the company choose to sell (abandon) the truck in order to maximize its NPV?

At what point in time would the company choose to sell (abandon) the truck in order to maximize its NPV?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Differentiate between stand-alone, corporate, and market risk.

Q9: Describe abandonment, growth, investment timing, and flexibility

Q10: Describe some methods of analyzing project stand-alone

Q11: Explain how a real option on a

Q12: What is a variable importance matrix?

Q13: Jimmerson Properties is considering a project that

Q14: Stephens Construction is considering an investment in

Q15: Wendt Publishing is considering a proposed project.

Q17: White Industries is considering a project that

Q18: Angelo Fibers is considering a project with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents