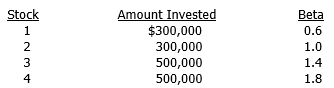

A money manager is holding the following portfolio: The risk-free rate is 6 percent and the portfolio's required rate of return is 12.5 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12.5 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

A) 11.91%

B) 12.24%

C) 12.87%

D) 13.63%

E) 14.12%

Correct Answer:

Verified

Q1: Which of the following statements is most

Q2: Parson Plastic's stock has an estimated beta

Q3: A U.S. investor bought a one-year French

Q4: Assume that the risk-free rate is 5.5

Q6: When does an analyst use population or

Q7: What is risk aversion and how is

Q8: If stocks' returns do not appropriately compensate

Q9: What is the difference between stand-alone and

Q10: What is the difference between diversifiable and

Q11: What is the capital asset pricing model

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents