Needsalift, Inc.

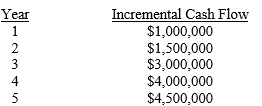

You are analyzing the potential acquisition of Nothing Better! Ice Creams, Inc. by your firm, Needsalift, Inc. The ice cream firm is a wholly owned subsidiary of Grand Lake Investments, which has set a firm selling price of $10,000,000. From your work you estimate that Nothing Better! will generate the following incremental cash flows for Needsalift:

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

-What is the value of the proposed acquisition to Needsalift?

A) $9,771,379

B) $10,666,344

C) $8,500,678

D) $10,596,175

Correct Answer:

Verified

Q1: What is the maximum price Smart Products

Q2: Suppose Smart Products' stock price is $40

Q4: Milner - Poudre

Milner Manufacturing plans to acquire

Q5: Smart Products

Suppose Smart Products has three divisions

Q6: Smith-Miler Merger

Smith Enterprises can acquire Miller, Inc

Q7: Smith-Miler Merger

Smith Enterprises can acquire Miller, Inc

Q8: 3D Company generates 50%, 40%, and 10%

Q9: Pickswinners Venture Fund

Pickswinners Venture Fund invested $10

Q10: Pickswinners Venture Fund

Pickswinners Venture Fund invested $10

Q11: WIMMP Venture Capital

"Where Is My Money" Professional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents