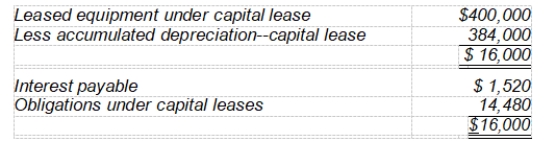

Estes Co. leased a machine to Dains Co. Assume the lease payments were made on the basis that the residual value was guaranteed and Estes gets to recognize all the profits, and at the end of the lease term, before the lessee transfers the asset to the lessor, the leased asset and obligation accounts have the following balances: If, at the end of the lease, the fair market value of the residual value is $8,800, what gain or loss should Estes record?

If, at the end of the lease, the fair market value of the residual value is $8,800, what gain or loss should Estes record?

A) $6,480 gain

B) $7,120 loss

C) $7,200 loss

D) $8,800 gain

Correct Answer:

Verified

Q44: Hay Corporation enters into an agreement with

Q45: Sele Company leased equipment to Snead

Q46: Eddy leased equipment to Hoyle Company on

Q47: Eddy leased equipment to Hoyle Company on

Q48: Hite Company has a machine with a

Q50: Durham Company leased machinery to Santi Company

Q51: Eby Company leased equipment to the Mills

Q52: Risen Company, a dealer in machinery and

Q53: Risen Company, a dealer in machinery and

Q54: Mayer Company leased equipment from Lennon Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents