The following information is available for Nielsen Company after its first year of operations: Nielsen estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $95,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

Nielsen estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $95,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

A) $105,000

B) $100,000

C) $95,000

D) $85,000

Correct Answer:

Verified

Q47: McGee Company deducts insurance expense of $84,000

Q48: McGee Company deducts insurance expense of $84,000

Q49: McGee Company deducts insurance expense of $84,000

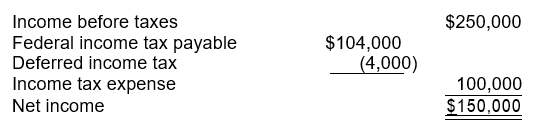

Q50: Tyler Company made the following journal entry

Q51: Tyler Company made the following journal entry

Q53: Kubitz Company reported the following items on

Q54: Nolan Company sells its product on an

Q55: Fesmire Co. had a deferred tax liability

Q56: Meyers Co. had a deferred tax liability

Q57: A reconciliation of Reaker Company's pretax accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents