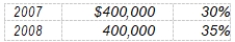

Peck Co. reports a taxable and pretax financial loss of $400,000 for 2009. Peck's taxable and pretax financial income and tax rates for the last two years were: The amount that Peck should report as an income tax refund receivable in 2009, assuming that it uses the carryback provisions and that the tax rate is 40% in 2009, is

The amount that Peck should report as an income tax refund receivable in 2009, assuming that it uses the carryback provisions and that the tax rate is 40% in 2009, is

A) $120,000.

B) $140,000.

C) $160,000.

D) $180,000.

Correct Answer:

Verified

Q54: Nolan Company sells its product on an

Q55: Fesmire Co. had a deferred tax liability

Q56: Meyers Co. had a deferred tax liability

Q57: A reconciliation of Reaker Company's pretax accounting

Q58: Mast, Inc. reports a taxable and financial

Q60: Bennington Corporation began operations in 2004. There

Q61: Ramos Corp.'s books showed pretax financial income

Q62: Eddy Corp.'s 2008 income statement showed pretax

Q63: On January 1, 2008, Lebo, Inc. purchased

Q64: On January 1, 2008, Magee Corp. purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents