On January 1, 2008, Alton Co. purchased $100,000 of 10%, Olson, Inc. bonds with interest payable on July 1 and January 1 for $107,000. On February 1, 2008, Alton purchased $100,000 of 12%, Ehrlich Co. bonds with interest payable on August 1 and February 1 for $95,000. Alton classifies the Olson and Ehrlich bonds as trading debt securities. On December 31, 2008, the fair value of the Olson and Ehrlich bonds are $110,000 and $94,000, respectively. At December, 2008, what adjusting entry should be made by Alton?

A) No entry should be made.

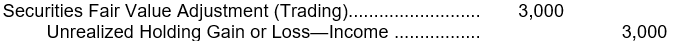

B)

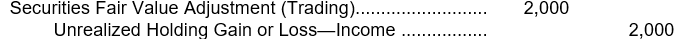

C)

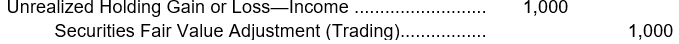

D)

Correct Answer:

Verified

Q23: Oliver Company purchased $400,000 of 10% bonds

Q24: On October 1, 2008, Porter Co. purchased

Q25: On November 1, 2008, Little Company purchased

Q26: On November 1, 2008, Morton Co. purchased

Q27: On October 1, 2008, Lyman Co. purchased

Q29: On January 3, 2008, Slezak Company purchased

Q30: On its December 31, 2007, balance sheet,

Q31: During 2007, Ellis Company purchased 20,000 shares

Q32: Garrison Co. owns 20,000 of the 50,000

Q33: Garrison Co. owns 20,000 of the 50,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents