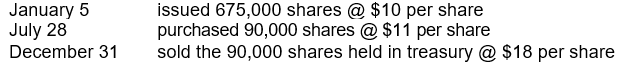

Trent Corporation was organized on January 1, 2008, with an authorization of 1,200,000 shares of common stock with a par value of $6 per share. During 2008, the corporation had the following capital transactions: Trent used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of additional paid-in capital as of December 31, 2008?

Trent used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of additional paid-in capital as of December 31, 2008?

A) $0

B) $2,070,000

C) $2,700,000

D) $3,330,000

Correct Answer:

Verified

Q36: Adler Corporation has 50,000 shares of $10

Q37: On September 1, 2008, Zelner Company reacquired

Q38: Gannon Company acquired 6,000 shares of its

Q39: King Co. issued 100,000 shares of $10

Q40: An analysis of stockholders' equity of Jinn

Q42: Watt Co.'s stockholders' equity at January 1,

Q43: Presented below is the stockholders' equity section

Q44: On December 1, 2008, Lynn Corporation exchanged

Q45: Vittly Corporation owned 900,000 shares of Nixon

Q46: Baden Corporation owned 20,000 shares of Terney

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents