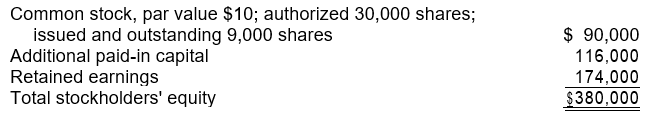

On December 31, 2007, the stockholders' equity section of Clark, Inc., was as follows:

On March 31, 2008, Clark declared a 10% stock dividend, and accordingly 900 additional shares were issued, when the fair market value of the stock was $18 per share. For the three months ended March 31, 2008, Clark sustained a net loss of $32,000. The balance of Clark's retained earnings as of March 31, 2008, should be

A) $125,800.

B) $133,000.

C) $134,800.

D) $142,000.

Correct Answer:

Verified

Q64: On May 1, 2008, Logan Co. issued

Q65: On May 1, 2008, Logan Co. issued

Q66: Sloane Corporation offered detachable 5-year warrants to

Q67: A corporation was organized in January

Q68: Norton Co. was organized on January 2,

Q69: In 2007, Marly Corp. acquired 9,000 shares

Q70: At its date of incorporation, Wilson, Inc.

Q71: Palmer Corp. owned 20,000 shares of Dixon

Q72: On May 1, 2008, Kent Corp. declared

Q74: On January 2, 2008, Carr Co. issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents