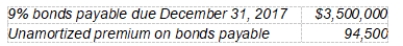

The December 31, 2008, balance sheet of Eddy Corporation includes the following items: The bonds were issued on December 31, 2007, at 103, with interest payable on July 1 and December 31 of each year. On January 2, 2009, Eddy retired $1,400,000 of these bonds at 98. What should Eddy record as a gain on retirement of these bonds? Ignore taxes.

The bonds were issued on December 31, 2007, at 103, with interest payable on July 1 and December 31 of each year. On January 2, 2009, Eddy retired $1,400,000 of these bonds at 98. What should Eddy record as a gain on retirement of these bonds? Ignore taxes.

A) $28,000

B) $37,800

C) $65,800

D) $70,000

Correct Answer:

Verified

Q37: Which of the following must be disclosed

Q38: Edson Corp. signed a three-month, zero-interest-bearing note

Q39: On January 1, 2008, Bleeker Co. issued

Q40: On January 1, 2008, Bleeker Co. issued

Q41: On October 1, 2008, Sinatra Corporation issued

Q43: On January 1, 2002, Gonzalez Corporation issued

Q44: The 10% bonds payable of Klein Company

Q45: A corporation called an outstanding bond obligation

Q46: A company offers a cash rebate of

Q47: A company buys an oil rig for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents