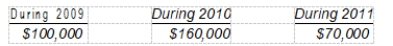

Dexter Co. sells major household appliance service contracts for cash. The service contracts are for a one-year, two-year, or three-year period. Cash receipts from contracts are credited to unearned service contract revenues. This account had a balance of $480,000 at December 31, 2008 before year-end adjustment. Service contract costs are charged as incurred to the service contract expense account, which had a balance of $120,000 at December 31, 2008. Outstanding service contracts at December 31, 2008 expire as follows: What amount should be reported as unearned service contract revenues in Dexter's December 31, 2008 balance sheet?

What amount should be reported as unearned service contract revenues in Dexter's December 31, 2008 balance sheet?

A) $360,000

B) $330,000

C) $240,000

D) $220,000

Correct Answer:

Verified

Q53: Vernon Co. is being sued for illness

Q54: On January 3, 2008, Alton Corp. owned

Q55: Presented below is information available for Norton

Q56: On January 1, 2008, Didde Co.

Q57: On its December 31, 2007 balance sheet,

Q58: On June 30, 2008, Rosen Co. had

Q60: During 2008, Blass Co. introduced a new

Q61: In March 2008, an explosion occurred at

Q62: On January 1, 2008, Gomez Co. issued

Q63: On July 1, 2006, Kitel, Inc. issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents