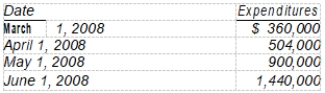

On March 1, 2008, Dennis Company purchased land for an office site by paying $540,000 cash. Dennis began construction on the office building on March 1. The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1. To help pay for construction, $720,000 was borrowed on March 1, 2008 on a 9%, 3 -year note payable. Other than the construction note, the only debt outstanding during 2008 was a $300,000, 12%, 6-year note payable dated January 1, 2008.

The office was completed and ready for occupancy on July 1. To help pay for construction, $720,000 was borrowed on March 1, 2008 on a 9%, 3 -year note payable. Other than the construction note, the only debt outstanding during 2008 was a $300,000, 12%, 6-year note payable dated January 1, 2008.

-The actual interest cost incurred during 2008 was

A) $90,000.

B) $100,800.

C) $50,400.

D) $84,000.

Correct Answer:

Verified

Q52: Glen Inc. and Armstrong Co. have an

Q53: Hardin Company received $40,000 in cash and

Q54: Jeter Company purchased a new machine on

Q55: Rubber Soul Company reported the following data:

Q56: Wheeler Corporation constructed a building at a

Q58: On March 1, 2008, Dennis Company purchased

Q59: During 2008, Aber Corporation constructed assets costing

Q60: Petty County owned an idle parcel of

Q61: Mack Co. takes a full year's depreciation

Q62: Gray Football Co. had a player contract

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents