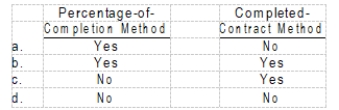

The Nathan Company is involved in the construction of an asset under a long-term construction contract. At the end of the third year of the five-year contract, the cost estimates indicate that a loss will result on the completion of the entire contract. In accounting for this contract, the entire expected loss must be recognized in the current period under the

Correct Answer:

Verified

Q16: Which of the following is not a

Q17: The percentage-of-completion method must be used when

Q18: Cost estimates on a long-term contract may

Q19: When there is a significant increase in

Q20: Under the completed-contract method of accounting for

Q22: Which of the following methods or bases

Q23: Under the installment-sales accounting method, certain items

Q24: How should the balances of progress billings

Q25: How should earned but unbilled revenues at

Q26: In accounting for long-term construction-type contracts, construction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents