Murphy Company sublet a portion of its warehouse for five years at an annual rental of $24,000, beginning on May 1, 2008. The tenant, Sheri Charter, paid one year's rent in advance, which Murphy recorded as a credit to Unearned Rental Income. Murphy reports on a calendar-year basis. The adjustment on December 31, 2008 for Murphy should be

A) No entry

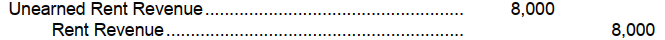

B)

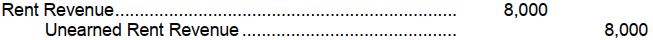

C)

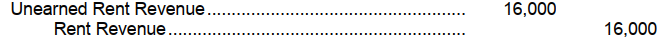

D)

Correct Answer:

Verified

Q14: Rent collected in advance by a landlord

Q15: How do these prepaid expenses expire?

Q16: Which of the following would not be

Q17: If expenses are greater than revenues, the

Q18: When a company uses a periodic inventory

Q20: Pappy Corporation received cash of $13,500 on

Q21: Tate Company purchased equipment on November 1,

Q22: During the first year of Wisnewski Co.'s

Q23: Brown Company's account balances at December 31,

Q24: Starr Corporation loaned $90,000 to another corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents