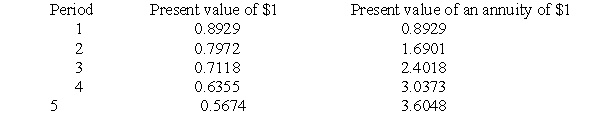

A firm is considering two alternative projects. Project A requires an initial expenditure of $100,000 plus an expenditure of $10,000 at the end of each the next five years. It will yield $98,000 in revenue at the end of the first year and at the end of the fifth year. Project B requires an initial expenditure of $50,000. It will yield $15,000 in net revenue at the end of each of the next five years. Both projects have a life of five years with no salvage value or disposal cost. The table below provides present value factors for the firm's discount rate of 12%. Calculate the net present value and profitability index of each project. Which project is preferred by each criterion?

Correct Answer:

Verified

100000?(10000)(3.6048...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A firm has found that the net

Q2: A firm is considering three investment projects

Q3: Firms generally use only one of the

Q4: According to the 1977 study by Gitman

Q5: A firm's marginal cost of capital (i)

Q6: A firm's marginal cost of capital (i)

Q7: A firm is considering two capital investment

Q8: A firm is considering two capital investment

Q9: A firm is considering two alternative projects.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents