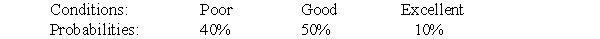

A firm is considering two business projects. Project A will return a profit of zero if conditions are poor, a profit of $4 if conditions are good, and a profit of $8 if conditions are excellent. Project B will return a profit of $2 if conditions are poor, a profit of $3 if conditions are good, and a profit of $4 if conditions are excellent. The probability distribution of conditions follows:

(i) Calculate the expected value of each project and identify the preferred project according to this criterion.

(i) Calculate the expected value of each project and identify the preferred project according to this criterion.

(ii) Assume that the firm has determined that its utility function for profit is as follows:

U(X) = X - 0.05X2

Calculate the expected utility of each project and identify the preferred project according to this criterion.

(iii) Is the firm risk averse, risk neutral, or risk seeking? How can you tell?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Branches coming out of circles on decision

Q8: Test marketing is an example of simulation.

Q9: The maximin criterion is a method of

Q10: A firm is considering two business projects.

Q11: A firm is considering two business projects.

Q12: A firm is considering two business projects.

Q14: A firm is considering three business projects.

Q15: A firm is considering three business projects.

Q16: A firm is considering three business projects.

Q17: A firm is considering three business projects.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents