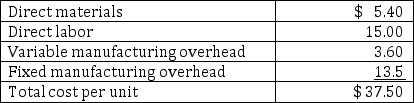

Blue Ridge Company currently manufactures 40,000 valves each year for use in one of its products. At this 40,000-unit level, the cost per unit for one of these valves is: An outside vendor has offered to sell 40,000 of the valves to Blue Ridge for $31 per valve. If Blue Ridge accepts this offer, the factory space being used to produce the valves could be leased to another company at an annual rental of $144,000. However, Blue Ridge has determined that 60% of the fixed overhead applied to the valves would continue to be incurred even if the valves were purchased from the outside vendor. What is the amount of financial advantage or disadvantage of accepting the offer from the outside vendor?

An outside vendor has offered to sell 40,000 of the valves to Blue Ridge for $31 per valve. If Blue Ridge accepts this offer, the factory space being used to produce the valves could be leased to another company at an annual rental of $144,000. However, Blue Ridge has determined that 60% of the fixed overhead applied to the valves would continue to be incurred even if the valves were purchased from the outside vendor. What is the amount of financial advantage or disadvantage of accepting the offer from the outside vendor?

A) $404,000 advantage.

B) $260,000 advantage.

C) $64,000 disadvantage.

D) $80,000 advantage.

Correct Answer:

Verified

Q48: Fitzpatrick Corporation makes a product sold to

Q49: Van Dusen Corporation produces several products from

Q50: Van Dusen Corporation produces several products from

Q51: Jones Enterprises manufactures three products, A,

Q52: Hyde Products, Inc., produces three grades of

Q53: Current business segment operations for Whitman, a

Q54: Backyard Environments produces a water fountain for

Q56: Reliance Aircraft Corporation currently manufactures a complex

Q57: Reliance Aircraft Corporation currently manufactures a complex

Q58: A Pareto analysis will indicate:

A) Which of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents