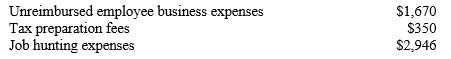

Marla and Victor Zapata have the following eligible miscellaneous itemized deductions:

They have an adjusted gross income of $63,000 and other itemized deductions of $8,580.How much of the above miscellaneous expenses can they add to their other itemized deductions?

A) $4,966

B) $3,706

C) $2,020

D) $0

Correct Answer:

Verified

Q150: Sally McKrachen is a single young professional

Q151: It is possible to deduct some types

Q152: Interest penalties for early withdrawal of savings

Q153: Total itemized deductions must be _ to

Q154: Which of the following is not a

Q156: A donation of old toys and clothes

Q157: Mike has a chronic illness.He had an

Q158: Adjusted gross income is not a factor

Q159: Kerri and Jason Smith have an adjusted

Q160: Qualifying contributions to personal retirement accounts are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents