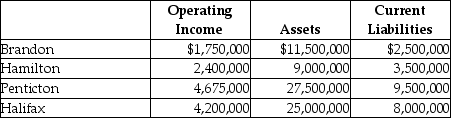

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million and book value of $8 million. The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centres in four divisions that operate autonomously. The company's results for the past year are as follows:

Required:

a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: The Coffee Division of Canadian Products is

Q33: The Tea Division of Canadian Products is

Q34: LaserLife Printer Cartridge Company is a decentralized

Q35: Capital Investments has three divisions. Each division's

Q36: Provide the missing data for the following

Q38: Last year Reynolds Ltd. reported the following

Q39: Chaucer Ltd. has current assets of $450,000

Q40: Consolidated Gas Supply Corporation uses the investment

Q41: Gasfield Maintenance Ltd. purchased equipment for $225,000

Q42: Use the information below to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents