Hendricks Ltd. of Calgary manufactures and sells computers. The Manufacturing Division is located in China and transfers 75% of its output to the Assembly Division in the Philippines. The balance of the product is sold in the local market at 2,100 yuan/unit. The Philippines division sells 20% of its output in the local market at 31,500 pesos/unit, with the balance shipped to Calgary. The Calgary operation packages the units and sells the final product at $1,900 Canadian per unit.

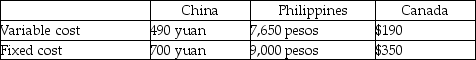

The following budget data are available:

Exchange rates are: $1 Canadian = 7 yuan and $1 Canadian = 45 pesos

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada. Income taxes are not included in the calculation of cost-based transfer prices. Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions. Take each calculation to 2 decimal places.

Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation. Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Walton Industries has two divisions: Machining and

Q36: Payne Ltd. has two divisions. The Compound

Q37: The Micro Division of Silicon Computers produces

Q38: The Assembly Division of Canadian Car Company

Q39: River Road Paint Company has two divisions.

Q40: Sonora Manufacturing Inc. designs and builds off-road

Q41: Global Giant, a multinational corporation, has a

Q42: Empire Ltd. has two divisions. Division C

Q43: Stavanger Ltd. is a Canadian company with

Q45: Clark Industries Ltd. manufactures monochromators that are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents