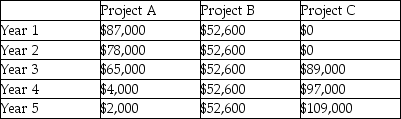

Hiroshi Inc. is evaluating 3 investment alternatives. Each alternative requires an initial investment cash outflow of $176,000 and is to be depreciated on a straight-line basis ($6,000 salvage value). Ignore income taxes. Cash flows for the various investments are summarized below:

The company has a required rate of return of 11.2%

Required:

a. rank each alternative based on NPV

b. rank each alternative based on IRR

c. rank each alternative based on accrual accounting rate of return using average annual cash flows

d. evaluate each project based on the payback periods

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Samuel Manufacturing Inc. is evaluating new machinery

Q30: Use the information below to answer the

Q31: Use the information below to answer the

Q32: Fabian Company is considering the purchase of

Q33: Fisher Ltd. is considering the purchase of

Q35: Supply the missing data for each of

Q36: Book & Bible Bookstore desires to buy

Q37: Hentgen and Ferraro, baseball consultants, are in

Q38: Jefferson Ltd. is considering the acquisition of

Q39: Sam's Structures desires to buy a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents