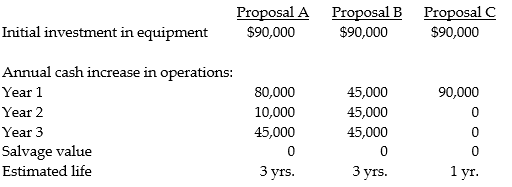

Hentgen and Ferraro, baseball consultants, are in need of a microcomputer network for their staff. They have received three proposals, with related facts as follows:

The company uses straight-line depreciation for all capital assets. Ignore income taxes.

Required:

a. Compute the payback period, net present value, and accrual accounting rate of return using average annual income, for each proposal. Use a discount rate of 14 percent.

b. Rank each proposal 1, 2, and 3 using each method separately. Which proposal is best? Why?

Correct Answer:

Verified

Payback for Proposal A: Year 1 $80,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Fabian Company is considering the purchase of

Q33: Fisher Ltd. is considering the purchase of

Q34: Hiroshi Inc. is evaluating 3 investment alternatives.

Q35: Supply the missing data for each of

Q36: Book & Bible Bookstore desires to buy

Q38: Jefferson Ltd. is considering the acquisition of

Q39: Sam's Structures desires to buy a new

Q40: Pender Ltd. is analyzing two proposals for

Q41: Xanadu Manufacturing Ltd. (XML) has two main

Q42: A Company wants to buy a moulding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents