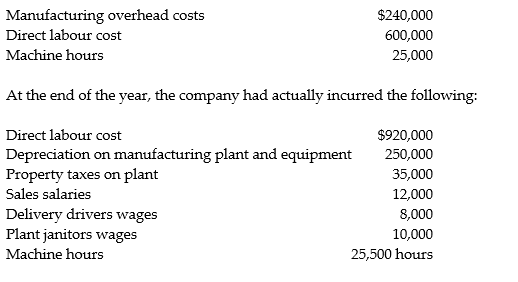

Sambell Manufacturing uses a predetermined manufacturing overhead rate to allocate

overhead to individual jobs. At the beginning of the year, the company expected to incur the following:

Required:

1. Compute Sambell's indirect cost allocation rate based on labour cost.

2. Compute Sambell's indirect cost allocation rate based on machine hours.

3. How much overhead was allocated during the year if the allocation base was direct labour cost?

4. How much manufacturing overhead was incurred during the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Fox Manufacturing is a small textile manufacturer

Q24: Hill Manufacturing uses departmental cost driver rates

Q25: Valley Manufacturing uses departmental cost driver rates

Q26: Jordan Company has two departments, X and

Q27: Sanders Company has two departments, X and

Q29: Northern Manufacturing uses a predetermined manufacturing overhead

Q30: An accounting firm provides tax consulting for

Q31: For each item below indicate the source

Q32: For each item below indicate the source

Q33: For each item below indicate the source

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents