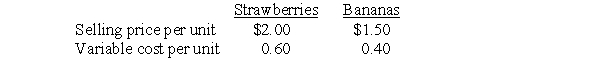

Thibodeaux Corporation produces hand-dipped strawberries and frozen bananas. Fixed product costs total $230,000 and fixed selling costs total $268,200. Product sales and cost information follow:

Thibodeaux sells six strawberries for every banana. The company's tax rate is 30%.

Thibodeaux sells six strawberries for every banana. The company's tax rate is 30%.

Required:

a. How many units of each product must Thibodeaux sell to break-even?

b. How many units of each product must Thibodeaux sell to earn $148,400 on a pre-tax basis?

c. How many units of each product must Thibodeaux sell to earn $207,760 on an after-tax basis?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: The constant mix assumption states that a

Q68: If a company uses a constant mix

Q69: A break-even graph provides the same accuracy

Q70: On a break-even graph, total fixed cost

Q71: On a profit-volume graph, the break-even point

Q72: If a company's sales revenue is $500,000

Q73: The degree of operating leverage ratio measures

Q74: Mandeville Corporation manufactures stuffed animals and has

Q75: Brouillette Corporation publishes inspirational books. The company

Q77: Mulvey Corporation manufactures hand painted vases. The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents