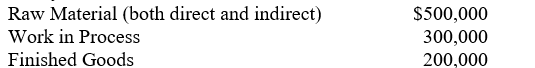

Jolly Time Corporation manufactures Christmas wreaths. Selected inventory information from Jolly Time's December 31, 2010 balance sheet is listed below.

Jolly Time's predetermined variable and fixed overhead rates, respectively, are $0.80 and $0.30 per direct labor hour (DLH) at an expected level of 500,000 DLHs of activity. The following transactions represent Jolly Time's inventory-related activity for the year ended December 31, 2010.

·Purchased 500,000 pounds of direct material for $700,000 cash.

·Purchased 100,000 gallons of indirect material for $100,000 on credit.

·Transferred direct material costing $900,000 and indirect material costing $103,000 to production.

·Paid direct labor costs (for 250,000 hours) totaling $450,000.

·Paid indirect labor costs totaling $100,000; 25% of this amount was for salaries and 75% was for wages.

·Paid utility costs totaling $20,000, of which 5% was fixed.

·Incurred $50,000 in straight-line depreciation expense on the production facility.

·Transferred $1,300,000 of completed goods from work in process to finished goods inventory.

·Sold inventory costing $1,400,000 for $3,500,000 cash. Jolly Time uses a perpetual inventory system.

Required:

a. Prepare journal entries for the information provided.

b. What are the ending balances of Raw Material, Work in Process, and Finished Goods Inventory?

c. Determine whether Jolly Time's variable and fixed overhead was underapplied or overapplied and by how much.

d. Compute Jolly Time's cost of goods manufactured for 2010.

e. Assume that underapplied or overapplied overhead is insignificant. Compute Jolly Time's cost of goods sold for 2010.

Correct Answer:

Verified

(Applying vari...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: When raw material is placed into production,

Q107: Total cost of goods to account for

Q108: Cost of goods manufactured can be computed

Q109: Under- or overapplied overhead is closed at

Q110: Service companies often have high direct labor

Q111: When services are completed, a service company

Q112: S Corp. incurred the following gas bills

Q113: May 2010 was Jones Corp.'s first month

Q114: Chalmette Corporation produces flat-bottom boats. Each boat

Q115: Casa Blanca Corp. produces sparkplugs and applies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents