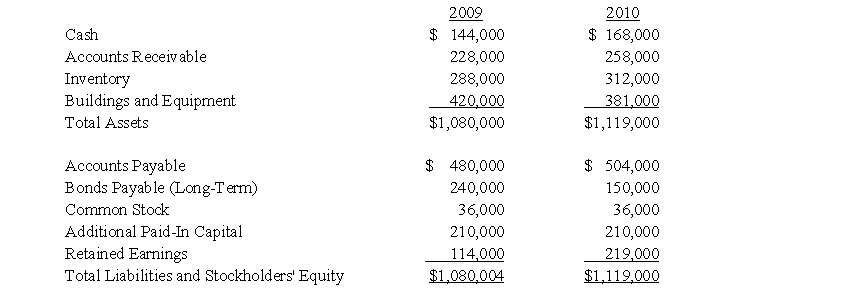

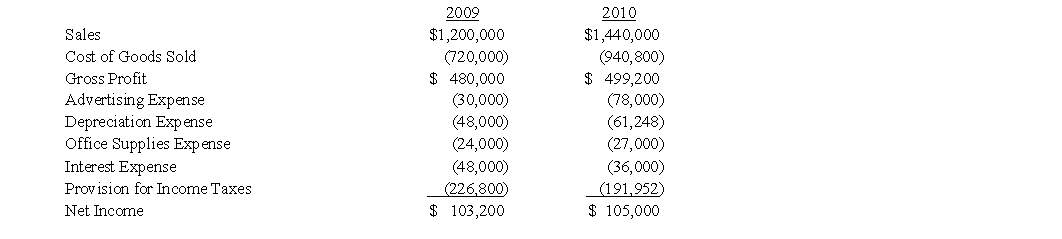

The following are Gladstone Corporation's 2009 and 2010 balance sheets and income statements.

Required:

a. Calculate Gladstone's current ratio at December 31, 2010.

b. Calculate Gladstone's quick ratio at December 31, 2010.

c. Calculate Gladstone's debt to total assets ratio at December 31, 2010.

d. Calculate Gladstone's long-term debt to equity ratio at December 31, 2010.

e. Calculate Gladstone's times interest earned ratio at December 31, 2010.

f. Gladstone is preparing a trend analysis for 2009 and 2010, using 2009 as the base year. What are the percentage relationships for (1) Buildings and Equipment and (2) Cost of Goods Sold?

g. Gladstone is preparing common-sized financial statements for 2010. What are the percentage relationships for (1) Inventory, (2) Bonds Payable, (3) Gross Profit, and (4) Net Income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Liquidity ratios measure a firm's ability to

Q104: Selling common stock for cash increases a

Q105: Leverage ratios measure how well a firm

Q106: The market price of a company's common

Q107: Preferred stock dividends should be added to

Q108: The following information is from D'Angelo Corporation's

Q109: The following information relates to the long-term

Q110: On September 1, 2010, Siez Co. purchased

Q112: The following are Rudolph Corporation's 2009 and

Q113: On December 31, 2010, Rex Corporation's common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents