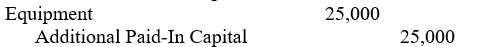

Bellview Corporation' first issuance of its $1 par value preferred stock was 400 shares for equipment with a fair market value of $25,000. How should Bellview journalize this transaction?

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q17: Deville Corporation issued 1,000 shares of $12

Q18: Par value of a share of stock

Q19: Redwing Corporation issued 500 shares of $1

Q20: Use the following information to answer questions

Q21: Use the following information to answer questions

Q23: McCallister Corp. acquired a machine in exchange

Q24: When stock is issued for services or

Q25: Dakora Corp. issued 1,000 shares of its

Q26: Treasury stock

A) is subject to preemptive right

Q27: A corporation's purchase of treasury stock causes

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents