A machine costing $33,000 with an estimated salvage value of $3,000 is to be depreciated on a straight-line basis over five years. The machine was purchased on April 1, 2009. What year-end depreciation adjusting entry should be made on December 31, 2010?

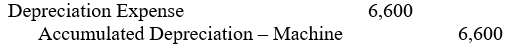

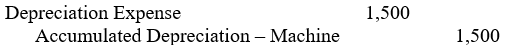

A)

B)

C)

D)

E) None of the above

Correct Answer:

Verified

Q39: An amount received by a business for

Q40: A company records interest that it owes,

Q41: A company records interest that it is

Q42: On January 1, 2010, Grey Corporation had

Q43: Real Sports Unlimited received $240,000 for multiple

Q45: On May 1, 2010, Pepper Corporation paid

Q46: On October 1, 2011, Railways Corp. signed

Q47: An internet service provider requires customers to

Q48: On September 1, 2010, Huntley Co. paid

Q49: An account whose period-ending balance is carried

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents