During your audit of the financial statements of Larrabee County on June 30, 2006, you discovered the following errors:

(1) The Accounts Receivable ledger account of the General Fund included $6,900 receivable from the county's Enterprise Fund for the Enterprise Fund's disposal of excess supplies on the General Fund's behalf. A Payable to General Fund ledger account with a balance of $6,900 was included in the accounting records of the Enterprise Fund.

(1) The Accounts Receivable ledger account of the General Fund included $6,900 receivable from the county's Enterprise Fund for the Enterprise Fund's disposal of excess supplies on the General Fund's behalf. A Payable to General Fund ledger account with a balance of $6,900 was included in the accounting records of the Enterprise Fund.

(2) During the year ended June 30, 2006, obsolete equipment with a carrying amount (residual value) of $18,700 was disposed of for $4,800. In addition, new equipment was acquired for $120,000. Both transactions were recorded only in the General Fund in the General Property ledger account, which had a debit balance of $115,200 on June 30, 2006. All items of equipment had been acquired from general fund revenues.

(3) During the year ended June 30, 2006, land with a current fair value of $650,000 was donated to Larrabee County for use as an industrial park. No journal entry had been prepared for the donation of the land.

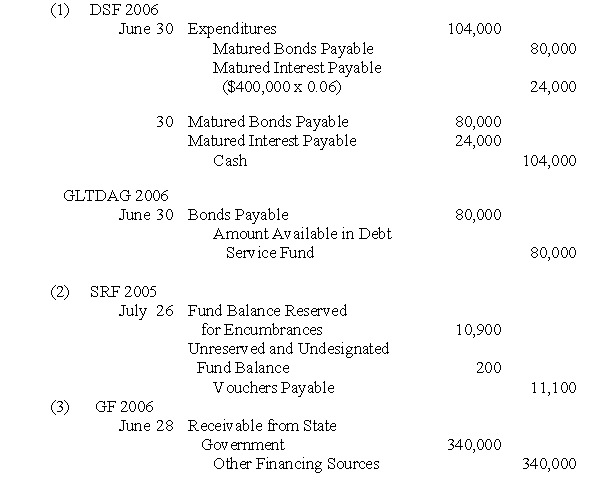

Prepare journal entries on June 30, 2006, to correct the foregoing errors in all affected funds and voluntarily maintained account groups of Larrabee County. Omit explanations, but identify by initials (GF, DSF, GCAAG, etc.) the fund or account group in which each journal entry is recorded.

Correct Answer:

Verified

Q21: On December 31, 2006, Dingle Township paid

Q22: Fred Bosin donated land and a building

Q23: A special revenue fund of a governmental

Q24: Which of the following funds of a

Q25: The appropriate journal entry (explanation and amount

Q26: Among the activities of Wilburtown for the

Q27: Indicate for each of the ledger accounts

Q28: St. Charles Township had the following transactions

Q30: The following journal entries were included in

Q31: In a classroom discussion of accounting standards

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents