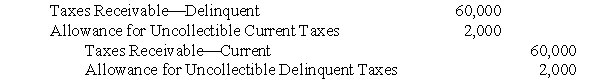

The following journal entry (explanation omitted) was in the general journal for the General Fund of Wabash County: The foregoing journal entry indicates that:

The foregoing journal entry indicates that:

A) Taxes have become uncollectible

B) Taxes have become delinquent

C) Taxes were misclassified in a previous journal entry

D) Delinquent taxes are doubtful of collection and current taxes are written off

Correct Answer:

Verified

Q21: Wages that have been earned by the

Q22: Which of the following increases the unreserved

Q23: In preparing the general fund budget of

Q24: Which of the following ledger accounts is

Q25: The current accounting standards for state and

Q27: The purpose of a governmental entity's general

Q28: In a governmental entity's general fund, are

Q29: The June 30, 2006, trial balance of

Q30: Following is the trial balance of the

Q31: During the months of June and July,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents